Reassessment notices were mailed late last month and have some Madison County residents holding tight to their purse strings.

During a recent board of supervisors meeting, several residents spoke out about the reassessment.

Yvonne Beatty noted that Madison County is one of the very few to not offer tax relief for the elderly. As noted several times over the past few years by local realtor Kevin Haney, the county offers a deferment, not a relief program and is one of the only counties in Virginia to not offer one. Beatty, who moved to the area in recent years, said she almost can’t afford to live in the county.

Resident Clint Hyde said he was amazed at the valuation number given to his home, saying it was 50% higher than last year. He asked the supervisors to be thoughtful and mindful of setting the tax rate, dropping it so it’s not “killing our citizens.”

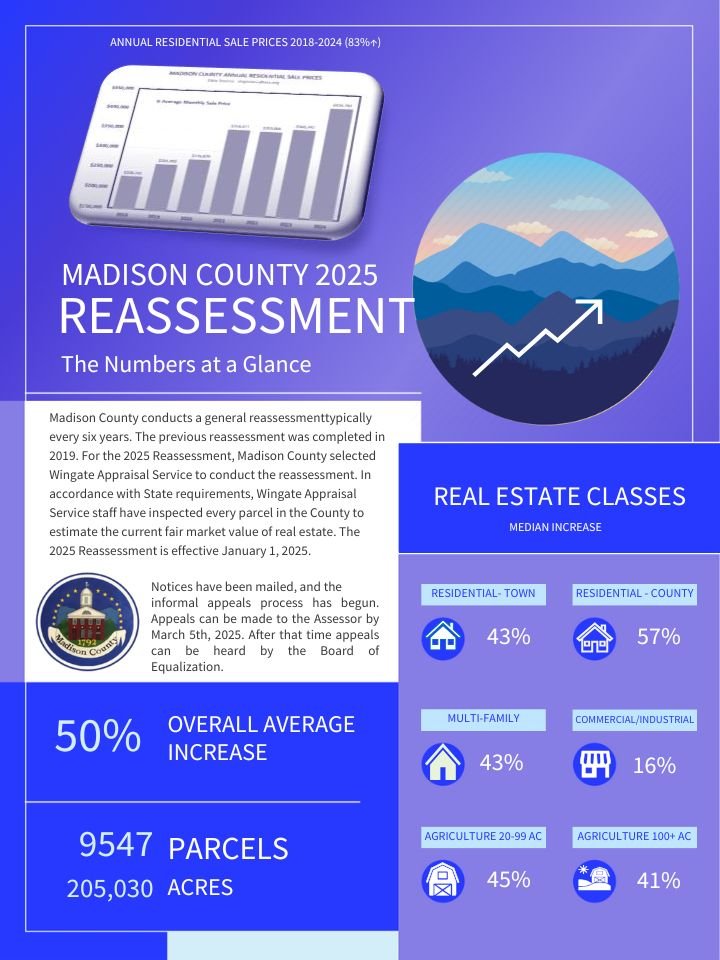

The assessment is higher. Last year, Madison County officials paid Wingate Appraisal Service $300,000 to perform the general reassessment. In accordance with state requirements, the company then inspected every parcel within the county to estimate the current fair market value of real estate. What Wingate found is an overall 50% increase for owners of the 9,547 parcels in Madison County. The median increase of residential property in town was 43% and in the county, 57%. The median increase for multi-family homes was 43%; commercial and industrial, 16%; agricultural up to 99 acres, 45% and over 100 acres, 41%. Overall, the estimated fair market value went from $2.7 billion collectively to $4 billion.

However, commissioner of revenue Brian Daniel said, it’s important to note the last reassessment was conducted in 2019 so some increase is to be expected. The county conducts a general reassessment every six years, the maximum amount of time allowed by state code. Some localities opt to assess more frequently, but according to Daniel, the cost to reassess prohibits the county from opting for more frequent reassessments. He said state code requires mailed notices to show the previous two years of values, but it may be better to put the prior assessment on there.

However, fair market value increasing by 50% doesn’t mean the real estate tax rate will increase by that amount. By law, the county must equalize the rate to within 1% of the prior real estate tax revenue.

“[The reassessment] is always a traumatic experience every time this is done,” supervisor Jim Jewett said. “The assessment is up 50%, but the tax rate isn’t going up 50%.”

He noted the board of supervisors has a history of equalizing rates as valuations change.

“We equalized the personal property tax rate in 2021 and then again in 2024, but it’s more volatile,” Jewett said. “I think the assessment company did its due diligence. [We’re] starting the [annual] budget process; we’ve kept spending down under the rate of inflation. The intent of the board is to look after the taxpayers in this county.”

“We’re not allowed to raise taxes through the assessment,” board of supervisors chairman Clay Jackson said. “The rate will go down, there’s no question and that’s independent of what we do with the budget.”

The supervisors will vote to equalize the tax rate during their April 8 meeting. They could then choose to increase that equalized rate during the budget process should the need for additional revenue arise. However, the real estate tax rate in Madison County has remained the same since 2020.